How do Stablecoins Work

Stablecoins are a unique class of cryptocurrencies designed to provide stability in a volatile market. Unlike traditional cryptocurrencies like Bitcoin and Ethereum, whose values can fluctuate wildly within a day, stablecoins are typically pegged to more stable assets like fiat currencies, commodities, or other assets. This pegging makes stablecoins an attractive option for those who want to take advantage of blockchain technology without being exposed to high volatility.

This article explains how stablecoins work, their different types, and why they matter in the world of decentralized finance (DeFi). Additionally, we’ll explore their benefits, risks, and the role they play in shaping the future of digital finance.

What Are Stablecoins?

Stablecoins are digital currencies that aim to keep their value stable relative to a specific asset. This “stability” is achieved through pegging mechanisms that tie the value of the stablecoin to assets like fiat currencies (e.g., USD), commodities (e.g., gold), or even other cryptocurrencies.

For instance, one of the most popular stablecoins, Tether (USDT), is pegged to the US dollar. Ideally, 1 USDT is always worth $1. By maintaining this stable value, stablecoins provide a medium of exchange and store of value that can be used within the cryptocurrency ecosystem without the wild fluctuations of traditional cryptocurrencies.

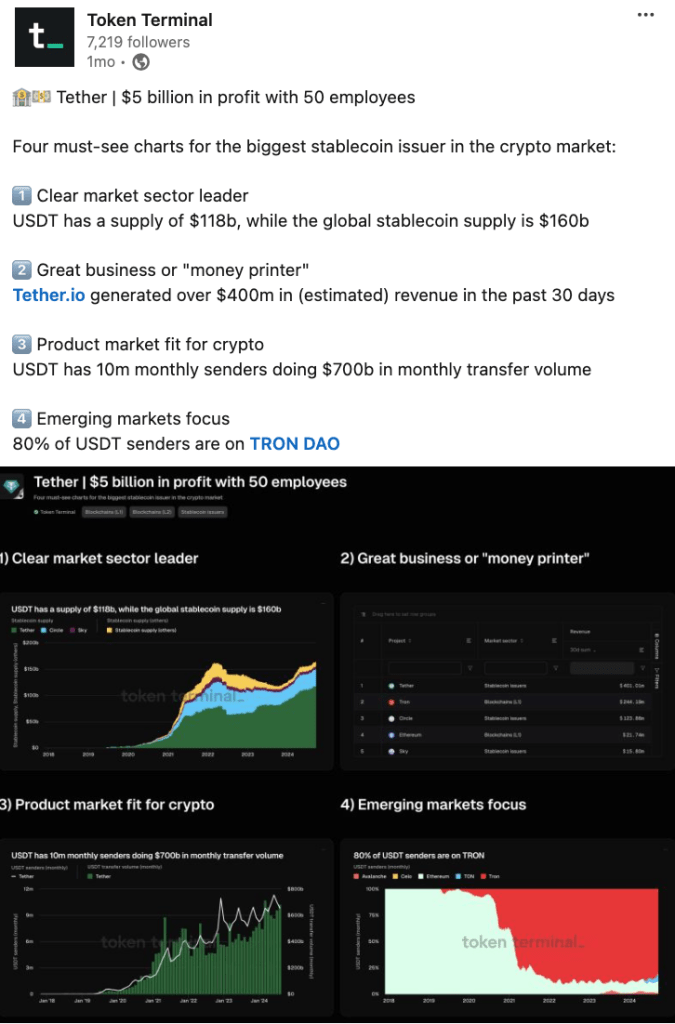

According to CoinMarketCap, the market cap of stablecoins reached over $160 billion in 2024, with USDT alone making up $118 billion of that total. The demand for stability in the otherwise unpredictable world of cryptocurrencies has made stablecoins one of the fastest-growing segments of the market.

How do Stablecoins Work?

Stablecoins work by maintaining a 1:1 peg with a specific asset. This is done through collateralization, which means backing each issued stablecoin with reserves that match the value of the pegged asset. These reserves could be anything from fiat currencies to commodities or other cryptocurrencies.

Collateralized Stablecoins

There are three primary types of collateralized stablecoins:

1. Fiat-backed Stablecoins:

These stablecoins are backed by reserves of fiat currencies, such as the US dollar or the euro. Tether (USDT) and USD Coin (USDC) are examples of fiat-backed stablecoins. The idea is simple: for every $1 issued in stablecoin, the issuing organization holds $1 in fiat currency in a reserve account. This ensures that holders of the stablecoin can redeem their tokens for an equivalent amount of fiat currency.

As of 2024, Tether holds $118.4 billion in reserves against $113.1 billion in liabilities, maintaining $5.3 billion in excess reserves.

2. Crypto-backed Stablecoins:

Unlike fiat-backed stablecoins, crypto-backed stablecoins use cryptocurrencies as collateral. One example is DAI, which is backed by Ethereum (ETH). Because cryptocurrencies are volatile, these stablecoins are often over-collateralized to absorb the fluctuations in value. For instance, to issue $100 worth of DAI, a user may need to lock up $150 worth of ETH as collateral.

3. Algorithmic Stablecoins

Another type of stablecoin is algorithmic stablecoins, which do not use traditional assets like fiat or cryptocurrency for collateral. Instead, they rely on algorithms and smart contracts to control the supply of the stablecoin. When the stablecoin’s value deviates from its peg, the algorithm either increases or decreases the supply to bring it back in line.

Algorithmic stablecoins are a more experimental approach to stability and have faced criticism due to the risks of de-pegging. One notable example of a failed algorithmic stablecoin is TerraUSD (UST), which lost its peg in 2022 and collapsed, causing billions in losses.

The Role of Stablecoins in Decentralized Finance (DeFi)

In the expansive world of Decentralized Finance (DeFi), stablecoins have emerged as an indispensable asset, serving as a bridge between the world of traditional finance and blockchain-based decentralized systems. DeFi represents a broad range of financial services – from lending and borrowing to yield farming, insurance, and decentralized exchanges – operating on blockchain technology without relying on intermediaries like banks.

Stablecoins play a critical role in powering this ecosystem by offering a stable medium of exchange, enabling liquidity, and providing a reliable unit of account for various financial applications. Let’s dive deeper into the nuances of their role and how they underpin the DeFi world.

Stability Amid Volatility

DeFi applications, much like the broader crypto market, are susceptible to high levels of volatility. This volatility is one of the major barriers to broader adoption of decentralized finance. Imagine taking out a loan in Ether (ETH) with the intention of paying it back over a few months. Due to ETH’s volatility, a sudden drop in its price could result in losing significant value, or conversely, if it spikes, the value of your repayment could drastically increase.

Stablecoins provide a much-needed anchor in this turbulent market. By maintaining a stable value, often pegged to a fiat currency like the US dollar, stablecoins allow DeFi users to enter into financial contracts, participate in liquidity pools, and engage in borrowing or lending with predictable value. This stability mitigates risks for DeFi participants and encourages more widespread usage of decentralized finance products.

Facilitating Liquidity and Trading

Liquidity is the lifeblood of DeFi. Without liquidity, decentralized exchanges (DEXs), lending protocols, and other DeFi services would struggle to function. Stablecoins contribute significantly to this liquidity, as they allow users to trade volatile cryptocurrencies while minimizing risk exposure.

For example, if a trader believes that the price of Bitcoin is about to drop, they can quickly swap their BTC for a stablecoin like USDC or USDT on a DEX, thereby preserving their capital.

Furthermore, stablecoins are integral to Automated Market Makers (AMMs), which power liquidity pools on many DEXs. Liquidity pools, often consisting of a stablecoin paired with a volatile asset like Ether, allow users to trade between the two without relying on centralized order books. Stablecoins ensure that users can quickly and easily access liquidity without being exposed to wild price swings.

Yield Farming and Lending

Stablecoins are also pivotal in yield farming and lending protocols. Yield farming involves providing liquidity to DeFi protocols in exchange for rewards, typically paid out in governance tokens or other cryptocurrencies. By using stablecoins for yield farming, users can earn returns without worrying about the value of their initial investment fluctuating wildly.

For example, lending protocols like Aave or Compound allow users to deposit stablecoins as collateral to earn interest. These platforms algorithmically determine interest rates based on supply and demand, with stablecoins often being in high demand due to their utility across the DeFi ecosystem.

As of August 2024, Compound reported that over 60% of its collateralized lending operations were backed by stablecoins like USDC and DAI. This high demand drives up the interest rates for stablecoin lending, making them a lucrative option for yield-seekers.

On the borrowing side, stablecoins provide a low-risk method for taking out crypto loans. Borrowers can pledge volatile assets like Ether or Bitcoin as collateral and take out loans in stablecoins, ensuring they have liquid capital to spend or reinvest without needing to sell their crypto assets.

The borrowing process becomes predictable and manageable since the debt is denominated in stablecoins rather than a more volatile cryptocurrency.

Enabling Cross-Border Payments and Remittances

Another key use case for stablecoins in DeFi is their application in cross-border payments and remittances. Traditional remittance services like Western Union or MoneyGram often involve high fees, slow processing times, and reliance on intermediaries. In contrast, stablecoins offer a faster and more cost-efficient alternative by enabling peer-to-peer transfers across borders with minimal transaction fees.

By integrating with DeFi protocols, individuals and businesses can send stablecoins to counterparts across the world in a matter of seconds. The cost savings are substantial, especially for people in countries with high remittance fees.

Stablecoins like USDT and USDC have become popular in regions such as Southeast Asia, Latin America, and Africa, where access to banking services may be limited but mobile phone and internet usage is widespread.

A Chainalysis report highlighted that Stablecoins now account for approximately 43% of the Sub-Saharan region’s (Africa) total transaction volume.

The stability of these digital currencies means that recipients don’t have to worry about exchange rate volatility, ensuring they receive the full value of their remittance.

Governance and Decentralized Stablecoins

In addition to asset-backed stablecoins like USDC or USDT, algorithmic and decentralized stablecoins like DAI play a critical role in DeFi. DAI, governed by the MakerDAO protocol, is pegged to the US dollar and backed by crypto collateral. What sets DAI apart is its decentralized nature – no single entity controls the issuance or management of DAI.

Instead, it’s governed by a decentralized community of stakeholders who vote on changes to the protocol, such as collateral types or stability fees.

The decentralized governance model behind DAI aligns with the broader ethos of DeFi, where control is distributed among users rather than concentrated in a single entity. While DAI’s peg to the US dollar provides the stability needed for DeFi applications, its decentralized issuance ensures it operates independently of traditional financial institutions.

As DeFi continues to grow, the use of decentralized stablecoins like DAI is likely to increase, providing an alternative to more centralized stablecoins, which some users may view as vulnerable to government regulation or institutional control.

Types of Stablecoins

Stablecoins can be categorized based on the type of collateral they use and how they maintain their peg. The primary types are fiat-backed, crypto-backed, and algorithmic stablecoins. Each has its own method of maintaining stability, and within these categories, there are well-known names that play critical roles in the crypto ecosystem. Let’s explore some of the key players and their distinctions.

1. Fiat-Backed Stablecoins

Fiat-backed stablecoins are the most common type, pegged to traditional currencies like the US dollar or the euro. They are backed by reserves of fiat currency held by a central issuer or trusted third party. These reserves ensure that for every stablecoin in circulation, there is an equivalent amount of fiat currency held in reserve.

One of the most prominent fiat-backed stablecoins is Tether (USDT). As of 2024, Tether is not only the leading stablecoin in terms of market cap, but it is also an integral part of the global crypto economy, with a supply of $118 billion, making up a significant portion of the $160 billion global stablecoin supply.

Tether’s role has grown significantly in recent years, particularly in emerging markets where it’s used as a vehicle to access US dollars. This demand is driven by its ease of use in cross-border transactions and the relative stability of the US dollar compared to local currencies.

Tether’s financial performance in 2024 has been nothing short of remarkable. In the first half of the year, the company reported a net profit of $5.2 billion, primarily driven by its massive holdings of US Treasury securities. With $97 billion in U.S. debt holdings, Tether ranks 18th globally, surpassing the holdings of major nations like Germany. In just the second quarter of 2024, Tether generated $1.3 billion in net operating profits, further highlighting its dominance in the stablecoin market.

An Analysis on Tether USDT from Token Terminal

The company’s financial health has allowed it to reinvest profits into strategic projects, including ventures into Bitcoin mining, artificial intelligence, and other high-tech areas. Tether’s growing influence in these industries is managed through Tether Investments, which currently holds a $6.2 billion net equity value.

Tether has become a crucial infrastructure asset for the global crypto economy. Interestingly, 80% of USDT transactions occur on the TRON network, which has become a popular blockchain for cost-effective and fast stablecoin transactions.

These statistics position Tether not only as a stablecoin powerhouse but also as a vital player in the broader adoption of blockchain technology.

Examples: Tether (USDT), USD Coin (USDC), Binance USD (BUSD).

2. Crypto-Backed Stablecoins

In contrast to fiat-backed stablecoins, crypto-backed stablecoins use other cryptocurrencies as collateral. These stablecoins are often over-collateralized to account for the volatility of the backing asset. For example, DAI, one of the most prominent crypto-backed stablecoins, requires users to lock up $150 worth of Ether (ETH) to create $100 worth of DAI.

While this model introduces a layer of complexity, it also aligns more closely with the decentralized ethos of cryptocurrency. DAI, issued by MakerDAO, is governed by a decentralized network of token holders, ensuring that no single entity controls its issuance or operations. As of 2024, DAI remains one of the most popular decentralized stablecoins, largely due to its over-collateralization, which reduces the risk of de-pegging.

Examples: DAI (backed by Ethereum), sUSD (backed by synthetic assets).

3. Commodity-Backed Stablecoins

These stablecoins are backed by physical assets such as gold, oil, or real estate. The value of the stablecoin is tied to the value of the commodity, making it a more tangible form of digital currency.

Gold-backed stablecoins, like PAXG, offer investors the ability to gain exposure to the price of gold without holding the physical commodity. According to CoinMarketCap, PAXG had a market capitalization of over $500 million in 2024.

Examples: Paxos Gold (PAXG), Tether Gold (XAUt).

4. Algorithmic Stablecoins

Algorithmic stablecoins are an entirely different breed. These stablecoins are not backed by any traditional asset or cryptocurrency but instead rely on algorithms and smart contracts to maintain their peg. The algorithmic approach adjusts the supply of the stablecoin based on market demand, attempting to stabilize the price.

However, algorithmic stablecoins have struggled to gain the same level of trust and adoption as their fiat- and crypto-backed counterparts. One of the most notorious examples of algorithmic stablecoins was TerraUSD (UST), which collapsed in 2022, leading to significant financial losses and a broader questioning of the viability of this model. As of 2024, algorithmic stablecoins are still in experimental stages, and investors remain wary due to the high risk of de-pegging.

Examples: Ampleforth (AMPL), Frax (FRAX).

Fiat-Backed Leading the Way

Among the various types of stablecoins, fiat-backed stablecoins, particularly Tether (USDT), have dominated the market. With a proven track record of profitability, massive reserves of U.S. Treasury assets, and a vital role in the global crypto economy, Tether remains the most widely used stablecoin worldwide.

While other models like crypto-backed and algorithmic stablecoins have their merits, fiat-backed stablecoins continue to offer the greatest sense of security and stability, making them the go-to choice for both traders and institutions. As the stablecoin market evolves, Tether’s position as the leading stablecoin will likely continue to solidify, shaping the future of digital finance.

Pros and Cons of Stablecoins

Pros

- Stability: The primary advantage of stablecoins is their ability to maintain a stable value, providing a hedge against the volatility of traditional cryptocurrencies.

- DeFi Utility: Stablecoins are essential for DeFi applications, allowing users to trade, lend, and borrow with reduced risk.

- Lower Transaction Costs: Stablecoins can facilitate cheaper and faster cross-border payments compared to traditional financial systems.

- Decentralization with Stability: Many stablecoins offer the best of both worlds — the decentralization of cryptocurrencies with the stability of traditional assets.

Cons

- Lack of Transparency: Some stablecoin issuers have been criticized for not providing enough transparency about their reserves. For example, Tether has faced multiple allegations regarding the sufficiency of its reserves.

- De-pegging Risk: Algorithmic stablecoins, in particular, are vulnerable to de-pegging. Even collateralized stablecoins can lose their peg in times of market stress.

- Regulatory Uncertainty: Stablecoins operate in a gray area when it comes to regulation. While some governments are moving towards regulating them, there is still a lot of uncertainty in this area.

The Future of Stablecoins

As stablecoins continue to gain traction, they are increasingly being seen as a bridge between the traditional financial system and the emerging world of decentralized finance. In developing countries, where access to stable currencies is limited, stablecoins like USDT have become a popular alternative. In 2024, 80% of Tether’s senders were located in emerging markets, according to a report by TRON DAO.

However, the future of stablecoins also depends on regulatory developments. Governments around the world are beginning to take notice of stablecoins and their potential impact on the global financial system. In the US, the Securities and Exchange Commission (SEC) and other regulatory bodies have expressed concerns about the lack of oversight and transparency in the stablecoin market.

As the stablecoin market continues to grow, we can expect more scrutiny from regulators, especially regarding the transparency of reserves and the risk of de-pegging. Nonetheless, stablecoins are likely to remain a vital part of the cryptocurrency ecosystem, offering a stable alternative for users who want to take advantage of blockchain technology without the risks of volatility.

How do Stable Coins Work: Conclusion

Stablecoins have revolutionized digital finance by offering stability in a volatile market, making them essential for traders, investors, and decentralized finance (DeFi) users. Acting as a bridge between traditional finance and blockchain, fiat-backed stablecoins like Tether (USDT) and USD Coin (USDC) provide confidence with real-world asset backing. However, risks such as reserve transparency and potential de-pegging persist.

As stablecoins grow in prominence, they offer a practical solution for those seeking the innovation of blockchain with the stability of traditional assets, reshaping the future of finance.

One reply on “How Do Stablecoins Work?”

[…] In Credit Mode, Nexo issues you a loan in fiat (USDx, EURx, or GBPx), using your crypto as collateral. You’re not selling anything. Instead, you’re borrowing against your holdings and can repay at any time, using fiat, crypto, or stablecoins. […]