When MetaMask announced a pilot payment card program, giving users the ability to spend crypto via EFTPOS the same way you do with fiat currency, I signed up as fast as I could. This article is my review of the MetaMask Card after a week of using it in the real world.

One of the biggest challenges most people face in crypto is converting their digital assets back into so-called “real money,” otherwise known as fiat currency. Whether you need some cash or want to spend your cryptocurrency gains (or cut your losses), the process of converting your crypto into fiat has always been cumbersome. While there are several crypto “off ramps” built for this exact purpose, it’s usually a slow and often expensive process. Several people (including myself) don’t even bother, especially not to access somewhat small sums that come from staking or DeFi rewards.

MetaMask is trying to change this by teaming up with MasterCard and Baanx and introducing one of the coolest crypto products I have seen in a long time—the MetaMask Card. This program was rolled out as a pilot in the EU and UK during August 2024, and I promptly joined the waiting list. By October, I received an email telling me I could access the card.

MetaMask, as a product at least, has had a difficult year. It’s long been criticized for having a slow and clunky user interface, and online forums are filled with people complaining about failed transactions. The fact that it’s mainly used for Ethereum means it has been associated with high gas fees as well. To add insult to injury, 2024 has seen a Solana renaissance, driven by transaction fees that are so small you don’t even think about them, alongside a surge in meme coins. Solana has taken a ton of traffic from Ethereum, and MetaMask has been pushed aside in favor of the Phantom wallet, the current cool kid on the block.

To make things worse, Phantom has been rubbing it in MetaMask’s face at every occasion.

The MetaMask Card is a big opportunity for MetaMask to showcase its still innovating and developing products that people will actually use. This is an opportunity for MetaMask to maintain its position as the most popular digital wallet and for positive sentiment to swing back in its favor.

MetaMask has promised that this initiative will “accelerate crypto adoption by removing barriers to spending.” If they can pull this off, it will surely be seen as a massive win for MetaMask and for crypto in general. There are lots of MetaMask users in crypto, and this is an opportunity to unlock serious value in the crypto space. In terms of my review, I will break it down into sections on the technology, setting up the card, and, of course, using it to buy stuff.

The Technology

As the pilot is with MasterCard, you can use the card where MasterCard is accepted. As I am based in Europe, that’s pretty much everywhere, so all good on that front. The card is powered by the Linea Layer 2 network, so you need to bridge your funds there in order to use the card. You can make payments with USDT, USDC, and WETH; however, I have only used USDC. I don’t have plans to use the other currencies, but I can see how they would be popular.

The setup process was straightforward and easy. There is a KYC component, and you will need to supply your name, address, email, phone number, and date of birth. However, it was very quick—much quicker than any bank I have signed up for (including Wise and Revolut). Overall, I found the experience pretty seamless.

Once that was done, I needed to bridge funds to the Linea network (I had never used Linea before), but if you have used a crypto bridge, it’s all the same. I actually had some staking rewards on another L2, which I converted to USDC and sent to Linea.

Side note: This was the first time I had taken some earnings from crypto and deployed them in a way that I could buy stuff. It was a pretty good feeling and felt like a sign that crypto is becoming more useful in the real world.

The setup is simple. Once you have added the funds, you need to set a spending limit (which you can change later if you want). You have the option of setting it to unlimited, which they recommend so you are not constantly updating the limit when you reach the max (and paying the associated gas fees). One thing I did notice is that you need to set a specific limit for each of the three cryptos. As I only wanted to use USDC, this didn’t matter much to me.

I want to start off by saying that the card itself has a very cool design, especially compared to TradFi cards; it really stands out. I don’t have a physical card, and I actually don’t think they are currently available. However, you can add the card to your phone via Apple and Google Pay, and it works like any other card you have.

MetaMask also provides a basic user interface to set up and manage your card. Just like with a TradFi card, you can download a list of transactions, freeze your card, and manage a spending limit. Unlike a typical bank card, you can prioritize which crypto you want to use (out of the three currently available). There is also the option to see/change your personal details. The card on the online MetaMask webpage has a toggle to show the card number, expiry date, and CVC. I wouldn’t say any of this is particularly special, other than the fact that it is all with crypto—but that’s the point.

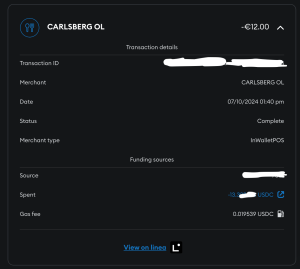

The most interesting part for me was looking at the individual transactions. It shows you all the payment information that you know from a regular card, but it also shows how much you pay in gas fees! Based on the transactions I made, it’s about 0.015 to 0.035 USDC per transaction. My guess is that it would probably take about 50 transactions to spend $1 in gas fees.

<Here is a screenshot of one of my transactions, all pretty normal except the gas fees.

The card works exactly like any other card. It’s almost a bit boring in that sense—it will sit in your mobile wallet with all the other cards. There is one disadvantage for the pilot markets in the UK and European Union: the card only accepts USDT and USDC stablecoins. At the time of writing, it doesn’t support EUR-based coins. This means that when you use it in the EUR markets, your USDT/C will get converted at the MasterCard exchange rates at the time of the transaction. These rates are usually a little bit more expensive than the standard rates. I’m sure that MetaMask will add support for EUR stablecoins soon, but at the moment, it means a slight price premium.

Personally, I think this is a great product and an easy way to spend your crypto. I might use some of my staking/DeFi rewards as spending money, especially for USD purchases. Even though there is a small gas fee, the ease with which you can use your crypto in the real world makes it worthwhile. This is undoubtedly the easiest crypto off-ramp I have seen.

In terms of things that could be better, the main improvement would be to add support for more stablecoin currencies, as I’d rather not use the MasterCard exchange rate. I am not sure if merchants have to pay a fee to MasterCard, given that we pay a gas fee, but I will update this blog as soon as I find out.

Overall, this card is a great idea. I plan to use it more, and I am interested to see if it becomes a mainstream tool.

You must be logged in to submit a review.

Copyright ©2025 Altcoin Analyst.