About This Solana Overview

This review of the Solana blockchain is a detailed analysis of Solana, a layer-1 cryptocurrency.

This Solana overview does not endorse or criticize the project but instead summarizes the key factors impacting Solana’s long-term success.

The information comes from the listed sources and is accurate at the time of writing; however, it may be subject to change.

Readers are encouraged to do their own research (DYOR) on Solana before making any investment decisions.

The author of this document does hold Solana in their portfolio. However, this study is written from an unbiased perspective.

This study is for informational purposes only and should not be considered financial advice.

Who Is This Solana Overview For?

– Individuals with beginner to intermediate knowledge of blockchain technology.

– People interested in Solana and seeking a detailed analysis of the project.

Part 1: The Solana Project

What Is Solana?

Solana is a layer-1 blockchain built for mass adoption, powered by the SOL token.

The Solana blockchain is a high-performance network used for various purposes, including finance, NFTs, payments, and gaming.

Solana operates as a single global state machine and is open, interoperable, and decentralized.

Solana is one of the largest and most well-known crypto projects, alongside Bitcoin and Ethereum.

What Makes Solana Different from Other Cryptocurrencies?

Solana is a layer-1 blockchain, which means it can function as a base layer for validating and securing transactions. Layer-1 blockchains can operate independently without relying on any other blockchain.

There are several layer-1 cryptocurrencies, each with unique designs and technology stacks. The most well-known examples are Bitcoin and Ethereum.

Bitcoin, the oldest and largest cryptocurrency, is often referred to as “digital gold” rather than a programmable network. It is primarily used as a digital store of value. Other layer-1 cryptocurrencies, such as Ethereum (the second largest by market cap), have the ability to process smart contracts and run decentralized applications.

Solana also has the ability to execute smart contracts and run decentralized applications, making it more comparable to Ethereum than Bitcoin. However, there are some key differences:

– Speed: Solana’s advantage is its speed, with tests showing it is capable of handling 3,900 transactions per second (TPS), significantly more than Ethereum’s 15 TPS.

– Proof of History (PoH): Solana is built on a protocol called “Proof of History” (PoH), which differs from Ethereum’s Proof of Stake and Bitcoin’s Proof of Work.

– Design: PoH is a technique for maintaining time between computers that do not trust one another, resulting in a fast network limited only by bandwidth.

– Cost: Solana’s cost per transaction is often below $0.01, making it one of the cheapest blockchains available.

These advantages make Solana one of the fastest-growing layer-1 blockchains in terms of user base, especially compared to Ethereum, its main competitor. However, critics argue that Ethereum’s protocol is more decentralized and, therefore, more secure. Ethereum has also managed to avoid significant network outages in its history, unlike Solana.

Solana is often compared to Bitcoin and Ethereum, but more for their differences than their similarities. A popular meme circulating in the crypto community highlights this comparison.

Solana History

The Solana whitepaper was published in 2017, and the project launched in June 2018.

Solana raised over $359 million; $25.5 million was from a public sale, while the remaining $334 million came from several funding rounds between 2018 and 2021. Some of the leading investors in Solana were Andreessen Horowitz (a16z), Polychain Capital, and Multicoin Capital.

The Solana whitepaper was written by Anatoly Yakovenko, who co-founded Solana with Raj Gokal. Anatoly is the more prominent member of the project. He previously worked at Dropbox and Qualcomm. Today, Anatoly is one of the most prominent figures in the crypto community, with over 411,000 followers on his X account. Based on our research, we believe he owns approximately 3.5 million SOL.

Note: You will often see references to two distinct entities when discussing Solana – Solana Labs and the Solana Foundation. Solana Labs is the company that built the Solana blockchain and is based in the United States; it is a for-profit entity. The Solana Foundation is based in Zug, Switzerland, and is a non-profit entity focused on the ongoing development of Solana, mainly through providing grants and conducting research.

Solana Today

According to LinkedIn data, Solana Labs has 233 employees, and the Solana Foundation has 271. Employees from Solana Labs have backgrounds in various technology and crypto organizations.

What Is Solana Trying to Achieve?

Solana aims to become the blockchain for mass adoption by offering high transaction throughput at a low cost.

In their own words:

“The goal is to ensure that not only can it be accessible to everyone, but that it can also be scalable enough to support real-world demand. For Solana, that means providing the fastest, low-fee, censorship-resistant blockchain to enable high-growth applications to democratize the world’s financial system.” – https://solana.com/news/why-solana-

Its closest competitor, Ethereum, while secure and trusted, is often criticized for high gas fees and low transactions per second. As Solana does similar things to Ethereum, its often branded in the media as an “Ethereum killer.”

Solana has attracted a strong following of users due to its high transaction throughput and very low fees. While it has not “killed” Ethereum, it has established its place in the crypto ecosystem and has been one of the best-performing blockchains of 2024.

Other blockchains have now emerged, known as “Solana Killers,” which are directly trying to compete with Solana. The best-known examples are SUI and Aptos.

Recently, competitor blockchains such as SUI and Aptos have generated significant excitement in the market, as investors see their price growth and trajectory mirroring Solana’s, albeit a few crypto cycles behind.

The Solana Network

Solana’s design enables it to handle significantly more transactions compared to Ethereum and the layer 2 blockchains created to improve Ethereum’s performance.

Solana has a much higher transaction throughput than Ethereum and its layer 2 solutions combined. This is due both to Solana’s PoH protocol and the fact that its less centralised that Ethereum.

The chart below of average TPS (transactions per second) shows that Solana is capable of reaching over 3,000 TPS, while Ethereum and its layer 2 scaling solutions struggle to surpass 100 TPS.

Solana also benefits from having an extremely low transaction fees. While they are significantly lower than Ethereum, they have actually been increasing recently due to the amount of activity on the Solana network.

Ethereum has been actively working to lower their transaction costs, the recent Dencun upgrade on the Ethereum blockchain reduced the transaction fees significantly. Thanks to this upgrade, several L2 transaction fees are now similar to Solana.

This is also reduced the traffic on the main Ethereum network which has lowered the Ethereum transaction fees, albiet still much higher than Solana and the other L2s

Despite Ethereum becoming more competitive on transaction fees, activity on Solana continues to increase.

In 2024, the number of unique addresses on Solana reached an all-time high, making Solana the most widely used blockchain.

Solana is now getting almost double the usage of Ethereum and its L2 blockchains.

What Has Been Driving Increased Usage on Solana?

The growth of Solana has been driven by several factors, the main ones being:

The 2024-2025 Crypto Bull Market: Q4 of 2024 marked the start of a crypto bull market, which saw a surge in interest across the entire crypto market. Solana, with its fast transactions and near-zero fees, was well-positioned to expand its user base.

Memes: Solana was able to capitalize on retail interest in meme coins with the launch of Pump.fun in January 2024. Pump.fun is a platform that enables anyone to create and trade their own meme coins with just a few clicks. This platform has been one of the standout performers on Solana.

Chart Showing the Increase in Activity on Pump.fun

Ease of Use: Unlike Ethereum, Solana is extremely cheap to use and does not require a layer 2 scaling solution. This makes it easier for new users to onboard.

In addition, one of the most user-friendly crypto wallets, the Phantom wallet, was initially designed for use on Solana.

Summary: The Solana Project

Solana aims to become the blockchain for mass adoption by offering high transaction throughput at a low cost.

Its closest competitor, Ethereum, while more secure, is often criticized for high gas fees and low transactions per second.

Solana’s high speed and low cost can unlock new crypto use cases, such as payments and gaming.

Solana has also gained traction in NFTs and gaming, use cases that require speed and low cost. Meanwhile, Ethereum continues to lead in DeFi, where security is a higher priority.

Unlike other projects prioritizing decentralization, Solana has focused more on speed and cost, even at the expense of decentralization.

Part 2: Usage of Solana

Solana Transactions History

Non-vote transaction history from 2022 indicates consistent, mildly increasing usage over time, usage spiked in January 2024. This spike aligns with the price of SOL rising alongside other cryptocurrencies.

Note: Voting transactions are submitted by validators for network consensus. Non-voting transactions are the transfer of SOL between different Solana accounts or smart contracts

Solana Active Addresses

Active addresses, like transactions, have also increased. This growth in active addresses has coincided with a resurgence in the price of SOL. The current number of active Solana wallets even surpasses those seen during the 2021 bull run.

Solana Transaction Fees

With the increase in Solana’s usage, there has also been a rise in the fees generated by users making transactions on the blockchain.

November 2024 was one of Solana’s best months ever, with transaction fees surpassing $195 million USD.

On October 28, 2024, Solana generated more in transaction fees than Ethereum for the day. However, Ethereum remains larger in overall fees and market capitalization.

Solana Use Cases

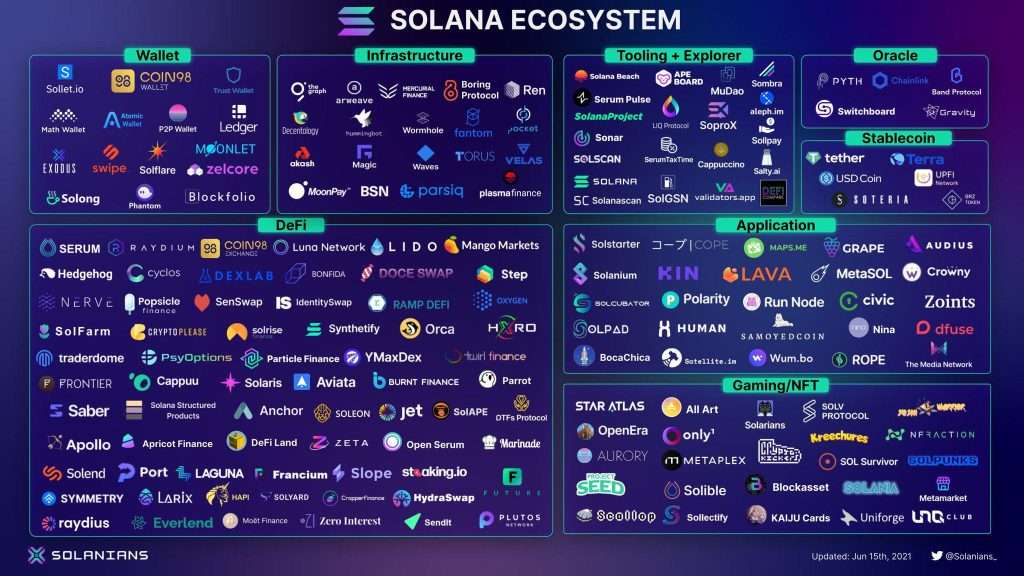

As a mainstream and established layer-1 blockchain, numerous projects are being built on Solana. Its use cases span gaming, NFTs, DePin, DeFi, and various other blockchain applications.

This is not an exhaustive list but highlights some of the more well-known projects.

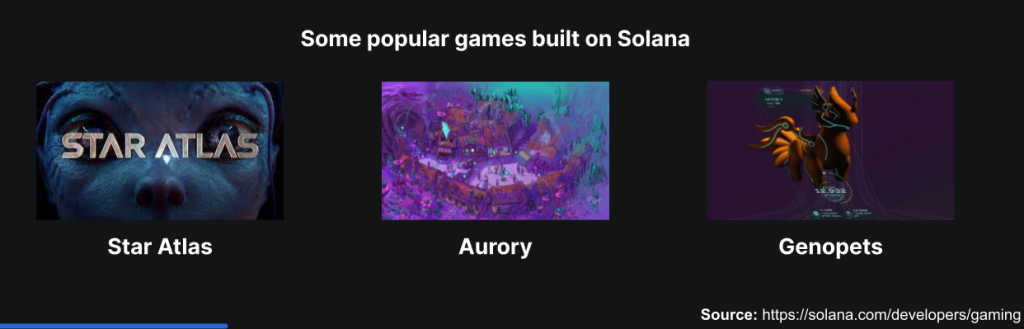

Gaming on Solana

Solana claims that its low transaction costs (a fraction of a cent) and high throughput make it an ideal platform for game developers. To support this, Solana Ventures provides funding specifically for gaming developers.

Additionally, Solana actively works to assist game developers in building on its blockchain. The Solana Games Kit, a collection of tools and services within the Solana ecosystem, is designed to help developers create Web3 games on Solana.

Several of these games also have their own governance coins that can be used for in game purchases or other use cases. These are all tradable on the Solana blockchain.

NFTs on Solana

Solana has significant cost advantages and has overtaken Ethereum in number of NFT traders. Ethereum remains dominant in value, but Solana is showing signs of challenging their dominance.

Note: in Feb 2024 the cost of buying an NFT on Solana was $0.0062 Compared to $55.39 on Ehtereum.

DeFi on Solana

The DeFi market, in general, declined during the bear market of 2022/23. However, it is now recovering to its previous levels.

Solana has seen its Total Value Locked (TVL) rebound alongside the broader crypto market and is now the second-largest DeFi protocol by TVL.

Despite Solana’s growth, its still remains a fraction of Ethereum. Solana has historically underperformed in the DeFi space relative to its market cap. This may be because it is considered less secure than Ethereum.

Solana Total Value Locked $USD

Source: DefiLlama

Share of TVL Across Major Chains

Source: DefiLlama

Payments on Solana

Solana Labs launched Solana Pay in 2022 as a payment service similar to Visa or PayPal.

Solana Pay is an open, free-to-use payment network offering instant transactions and near-zero gas fees. Users can settle transactions in USDC, a Solana-based stablecoin.

Solana Pay is integrated with Shopify, making it accessible to millions of businesses. Shopify accounts for 10% of total U.S. e-commerce.

This product positions Solana as a competitor to established payment companies like Visa and Mastercard.

Other Solana Applications

Hivemapper is a decentralized mapping project built on the Solana blockchain that incentivizes users to collect road-level imagery using dashcams. Contributors earn HONEY tokens as rewards for their mapping efforts, promoting community involvement and ensuring data accuracy. The collected map data is then sold to companies, which burn HONEY tokens in the process, potentially increasing the token’s scarcity and value over time.

Pyth Network is a Solana-based oracle solution that provides accurate, high-frequency market data on demand. Its unique “pull” model reduces latency, enhances scalability, and shifts update costs to data consumers. By sourcing data from over 110 trusted financial institutions and trading firms, Pyth ensures reliable, real-time information, making it a crucial oracle for decentralized finance (DeFi) projects on Solana and beyond.

Developer Activity

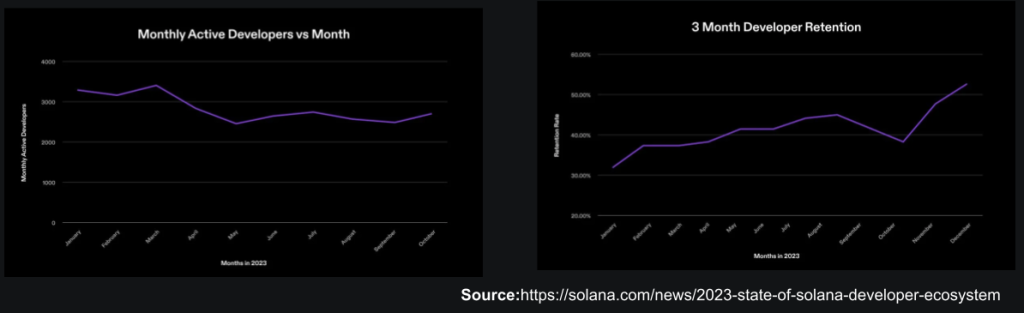

In 2023, Solana had between 2,500 and 3,000 monthly active developers building on its blockchain. Developer retention also increased from 30% to 50%, indicating that not only are more developers building on Solana, but they are also contributing more consistently over time.

While Solana has not released updated figures, given the current hype surrounding the platform, it is safe to assume that developer activity will remain strong for the foreseeable future.

Summary: Usage of Solana

Solana is often referred to as an “Ethereum Killer” due to its lower costs and faster transaction speeds. However, it still lags behind Ethereum in several key usage metrics.

Solana has carved out a niche, establishing strong positions in gaming and NFTs. Its payment partnerships could position it to enter a new trillion-dollar market.

In DeFi, Solana trails behind Ethereum and other Layer 2 solutions and may never become a leader in this space.

Developer activity on Solana is trending positively, indicating that people are still building on the platform.

With its advanced technology, Solana remains an attractive platform for developers and is likely to continue as a leading cryptocurrency, though it will probably remain behind Ethereum.

Part 3: Buying and Holding Solana

Buying Solana

Solana is currently the fifth-largest cryptocurrency by market capitalization and is growing rapidly. It is widely available on all major centralized cryptocurrency exchanges.

Storing Solana

As Solana is a major blockchain, several cold storage wallets support it alongside other blockchains. For example, Trezor, which already supports Bitcoin and Ethereum, recently announced its support for Solana.

The most popular hot wallet by far is Phantom. It has nearly 650,000 followers on X and is highly active within the crypto community. Phantom was originally made for Solana, however it now supports several other networks like Ethereum and SUI.

Staking Solana

As of December 2024, over 386.7 million SOL tokens were staked. Marinade has long been the leading protocol; however, Jito has seen its TVL surpass $400 million following the launch of its Jito token in November 2023.

Solana Liquid Staking Protocols TVL

Source: DefiLlama

Tokenomics

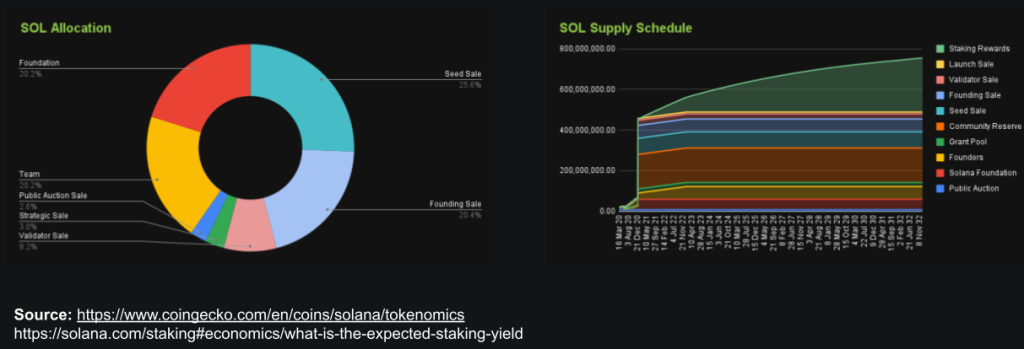

SOL had an initial supply of 500m launched at $0.20 in 2020. It has an unlimited supply and is expected to reach 700m tokens by 2030.

-Solana’s proposed inflation schedule with an initial inflation rate of 8% and will decrease by 15% every year until it achieves a long-term inflation rate of 1.5% (expected 2030).

-All inflationary tokens will be distributed to stake accounts and validators.

-Solana’s current inflation rate as of December 2024 is around 4.9%

-There are currently 476m tradable SOL tokens in circulation.

Security

The Solana network is validated by thousands of nodes that operate independently to ensure data remains secure and censorship-resistant.

Validator nodes process transactions and participate in consensus to improve the network’s security. At the time of writing, there are 1,433 validator nodes online.

Validators are incentivized to participate by getting a share of transaction fees and other protocol-based rewards.

Solana also has a bug bounty program that rewards people who can identify network vulnerabilities.

Depending on the severity of the vulnerability. Submitters can earn anything from 25k SOL to 20 SOL.

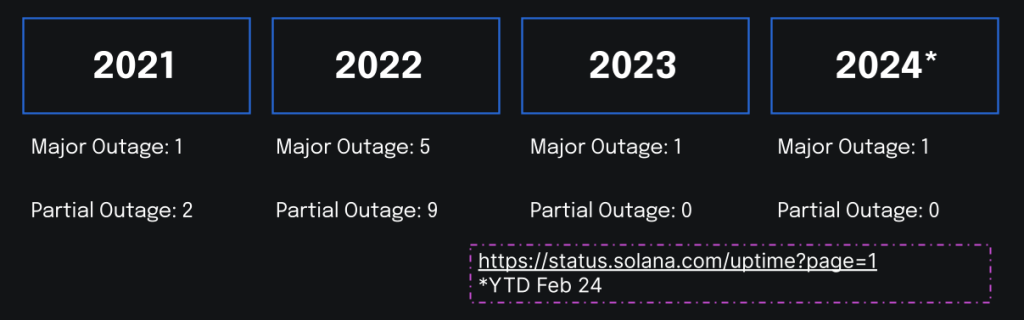

Network Outages

Solana has been somewhat infamous for outages. However, this has improved recently, and before the outage on 6th Feb 2024, Solana was on its longest streak without recording an outage.

Planned Upgrades: Firedancer

The main item on the Solana roadmap is the Firedancer upgrade. This is billed as a major enhancement for the Solana blockchain, developed by Jump Trading, it aims to significantly improve the network’s performance and reliability. Here are key points about Firedancer:

Validator Client Reimplementation: Firedancer is a reimplementation of Solana’s validator client, designed to enhance the efficiency and scalability of the network.

High Throughput: Firedancer aims to support over one million transactions per second, which will greatly increase the network’s capacity and even make it faster than comapnies like Visa.

Decentralization: By diversifying the validator ecosystem, Firedancer seeks to improve decentralization, making the network more resilient against outages and attacks.

The full rollout of Firedancer is anticipated by 2025 however, preliminary versions are expected to be released earlier, allowing for gradual integration and testing.

Potential Solana ETF?

Grayscale Investments has filed to convert its Grayscale Solana Trust into a spot exchange-traded fund (ETF) listed on NYSE Arca. If approved, the ETF would make Solana more accessible to retail and institutional investors without requiring direct token ownership. Grayscale has already established Bitcoin and Ethereum ETFs.

While a Solana ETF could increase liquidity and attract broader investment, the short-term likelihood of approval remains low. Regulatory attitudes toward crypto are evolving, but a Solana ETF would still face hurdles before gaining approval. If approved, it could enhance Solana’s appeal and drive upward price pressure.

Part 4: Solana Price History

Solana Price History

Solana launched to the public at $0.95 and peaked at $255 in December 2024 (the start of the current bull run).

Given that the crypto bull market has just started, the general expectation is that Solana will continue to rise during 2025. However, this will largely depend on the performance of the broader crypto market.

Track all markets on TradingView

Market Capitalization

Solana reached its latest all-time high (ATH) in late 2024 as a result of the ongoing crypto bull market.

For most of the crypto world, Solana is considered the third-largest cryptocurrency after Bitcoin and Ethereum. However, there is an argument that it is underperforming if its market cap falls outside the top four. Tether (the largest stablecoin) usually holds the third position.

The crypto community often discusses the possibility of Solana one day “flipping” Ethereum. However, as of December 2024, Solana’s market cap is only a quarter of Ethereum’s.

Solana Blockchain Review: SWOT Analysis

Strengths

Fast transaction speeds, high throughput, and low cost make Solana one of the top-performing blockchains.

Established in 2018, Solana has a strong following in the crypto community and is regarded as a ‘blue-chip’ cryptocurrency.

Growing Adoption: Solana is increasingly popular within the crypto community and has become a common entry point for newcomers to crypto.

Opportunities

Gaming: Solana’s speed and low cost make it one of the best cryptocurrencies for Web3 gaming.

Payments: Solana already has a payment service, and it could eventually evolve into a payment network that competes with companies like Visa and PayPal.

Solana ETF: In the unlikely event that a Solana ETF is approved, it could attract retail investors, resulting in upward price pressure.

Weaknesses

Outages: Solana has a reputation for network outages. If these persist, they may deter developers and companies from building on the platform.

DeFi: Considering Solana’s market cap, its Total Value Locked (TVL) in DeFi projects is relatively small.

Threats

Solana Killers: New layer-1 projects like SUI and APTOS claim to outperform Solana, although this has yet to be proven. These projects offer similar benefits to Solana and could potentially take market share in the medium term.

Memes: While Solana has gained significant attention for its meme coins, the majority of these are scams. Over time, this could harm Solana’s brand image.

Solana Blockchain Review: Summary

Despite being labeled as an “Ethereum Killer,” nobody expects Solana to challenge Ethereum’s dominance in the market.

This is particularly obvious in DeFi, where Solanas TVL is significantly behind ETH and several layer 2s. There are few signs to suggest this will change.

This is not to say that Solana has not become a major cryptocurrency in its own right; its speed and low cost make it a better choice for several use cases.

Solana has the potential to be a leader in payments, NFTs, and even games, use cases where speed and low fees are fundamental.

With Solana’s current adoption and market capitalization levels, Solana is expected to remain a significant blockchain alongside Bitcoin and Ethereum for the foreseeable future.

If you have any questions about this study, email us at [email protected].

For more Altcoin Insights, visit our blog.

What did you think of our Solana Blockchain Review? leave your thoughts in the comments below.

Sources:

solana.com/docs

https://solana.com/docs/intro/history

https://www.datawallet.com/crypto/solana-vs-ethereum

Source: https://cryptorank.io/ico/solana?page=1 https://solana.com/docs/intro/history

https://techcrunch.com/ ,finance.yahoo.com/news/solana-almost-2-700-past-113000123.html

https://solanapay.com/

https://solanacompass.com/tokenomics

https://solana.com/validators#is-there-a-bug-bounty-program,

https://github.com/solana-labs/solana/blob/master/SECURITY.md#bounty