The Bitcoin Halving of 2024: Everything You Need to Know

The year 2023 witnessed a remarkable turnaround for cryptocurrency. After a brutal bear market, digital assets roared back, with Bitcoin leading the charge. In March, the world’s most popular cryptocurrency shattered its all-time high, reaching a staggering $73,750.

Experts predict continued growth fueled by the highly anticipated Bitcoin halving event scheduled for April 2024.

Bitcoin, the world’s leading cryptocurrency, is gearing up for a significant event in April 2024: the halving. This pre-programmed occurrence within Bitcoin’s code cuts the block reward for miners – the individuals who verify transactions and secure the network – in half.

What Is Bitcoin Halving?

The Bitcoin halving is a programmed update in Bitcoin’s code that happens about every four years. During this update, the reward for miners gets cut in half. Miners are the people who use powerful computers to solve complex math problems to keep Bitcoin secure. So, after the halving, they get fewer Bitcoins for doing the same amount of work.

Why Does Bitcoin Halving Matter?

The halving serves two critical purposes:

- Limited Supply: Bitcoin’s total supply is capped at 21 million coins. The halving ensures a predictable and gradual release of new Bitcoins into circulation. This controlled scarcity contributes to Bitcoin’s value proposition as a scarce digital asset.

- Monetary Policy Tool: Similar to how central banks manage interest rates, the halving acts as a built-in economic tool. By reducing the number of new Bitcoins entering the market, it aims to influence long-term price stability.

When is the Next Bitcoin Mining Taking Place?

Estimates suggest the next halving will take place around April 20th, 2024. This time frame provides a clear picture for investors, miners, and enthusiasts to prepare for this significant event within the Bitcoin ecosystem.

It’s important to understand that the halving doesn’t directly impact individual Bitcoin holders. Instead, it works behind the scenes, influencing the process of creating new Bitcoins. So, while you might not see an immediate change in your Bitcoin holdings, the halving has the potential to cause ripples throughout the Bitcoin network.

The Mechanics of the Halving Explained

The Bitcoin halving involves two key changes happening under the hood of the Bitcoin network:

Reward Reduction:

Miners are the ones who verify transactions and secure the Bitcoin network. They do this by solving complex math problems using powerful computers. As a reward for their work, they get Bitcoins. The halving is like a built-in rule that cuts this reward in half roughly every four years. Currently, miners receive 6.25 Bitcoins for solving a problem.

After the April 2024 halving, they’ll only receive 3.125 Bitcoins for the same amount of work.

Difficulty Adjustment:

To keep things fair, the Bitcoin network automatically adjusts the difficulty of the math problems miners need to solve. Think of it like this: even though the reward gets smaller after the halving, the difficulty of the problems miners need to solve doesn’t become easier.

The network automatically adjusts the difficulty to maintain a consistent time for solving these problems (around 10 minutes). This means miners might need to use more computing power to solve the problems and get their smaller reward.

In simpler terms, it’s like the system automatically adjusts the difficulty of a video game level even though the reward for completing it gets smaller.

What Role Does the Halving Event Play in Shaping Bitcoin’s Monetary Policy?

These halving events play a crucial role in shaping Bitcoin’s monetary policy, emphasizing its finite supply and deflationary nature. They contribute to Bitcoin’s narrative as “digital gold” and underscore its potential as a hedge against inflation, making it an intriguing asset for investors seeking alternative stores of value in the digital age.

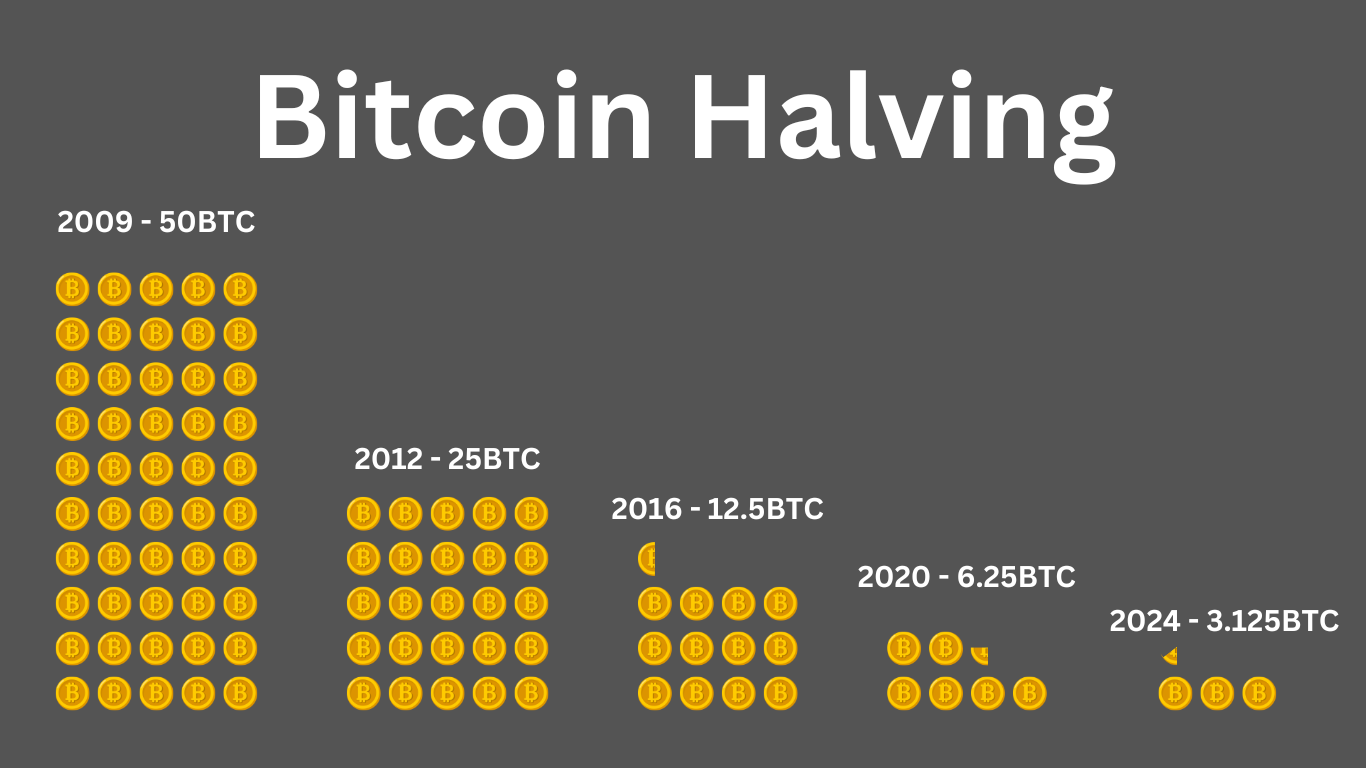

A Look at Bitcoin Halving Dates and Rewards

Halving date | Reward |

| 3 January 2009 | 50 BTC |

| 28 November 2012 | 25 BTC |

| 9 July 2016 | 12.5 BTC |

| 11 May 2020 | 6.25 BTC |

| (Expected) April 2024 | 3.125 BTC |

| (Expected) 2028 | 1.5625 BTC |

The table above lists the historical and expected future halving dates along with the corresponding rewards given to miners for validating transactions on the Bitcoin network. Initially set at 50 bitcoins per block, the reward halves every halving event, hence the term “halving.”

3 January 2009: This marks the genesis of Bitcoin and the initiation of mining activities. Miners were rewarded with 50 bitcoins for every block they successfully mined.

28 November 2012: The first halving event occurred, reducing the block reward from 50 bitcoins to 25 bitcoins. This event signaled a milestone in Bitcoin’s monetary policy, highlighting its scarcity and deflationary nature.

9 July 2016: The second halving event reduced the block reward further to 12.5 bitcoins per block. This event underscored Bitcoin’s predictable supply schedule, distinguishing it from fiat currencies subject to central bank interventions.

11 May 2020: The third halving event, reducing the block reward to 6.25 bitcoins, occurred amidst growing interest and adoption of Bitcoin by institutional investors and mainstream financial institutions.

April 2024: Based on the programmed protocol, the fourth halving event is anticipated to take place, further reducing the block reward to 3.125 bitcoins per block. This event is eagerly awaited by the Bitcoin community as it reinforces the digital asset’s scarcity narrative.

(Expected) 2028: Looking ahead, subsequent halving events are expected to occur, with each event halving the block reward until the maximum supply of 21 million bitcoins is reached. By this stage, the rate of new bitcoin creation will be infinitesimally small, enhancing Bitcoin’s store of value proposition.

What is Bitcoin Halving’s Impact on the Price?

Bitcoin has a finite supply capped at 21 million coins. Halving reduces the rate at which new Bitcoins enter circulation, essentially creating scarcity. If demand for Bitcoin remains constant or increases, this decrease in supply could theoretically drive up the price.

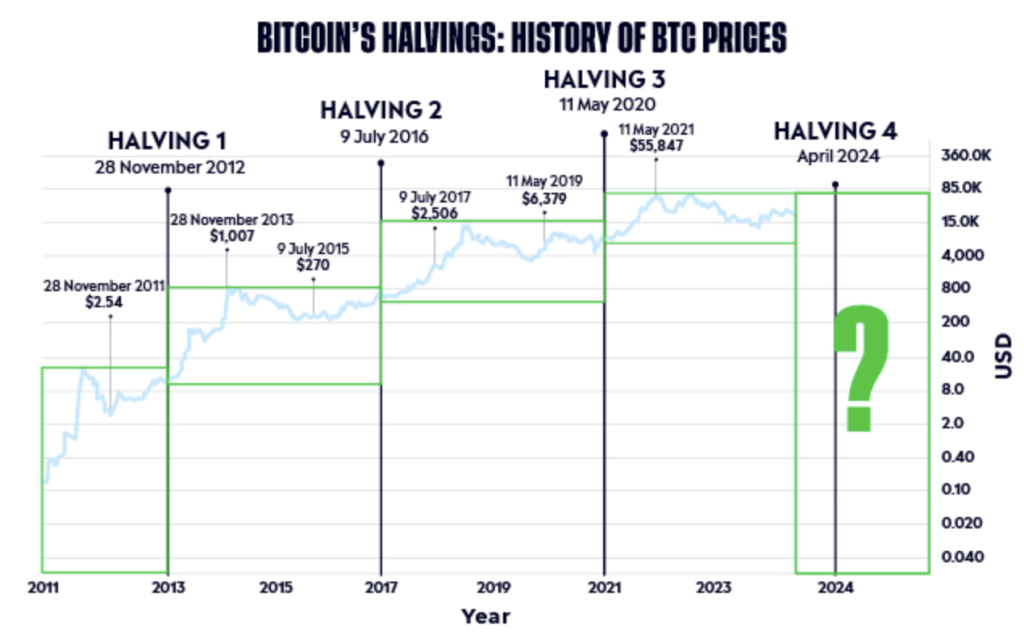

Historically, there has been a correlation between halving events and price surges. The first halving in 2012 saw Bitcoin’s price rise from around $12 to over $1,000 within a year. Similarly, the 2016 halving preceded a bull run that took prices close to $20,000, and the 2020 halving was followed by Bitcoin reaching its all-time high of nearly $70,000.

The historical price of Bitcoin (BTC), along with the past Bitcoin halvings, is overlayed. Important: Historical performance is not an indicator of future results.

Not a Guaranteed Price Increase

However, it’s important to understand that the relationship between halving and price is not a guaranteed cause-and-effect. Several other factors can influence Bitcoin’s price, making it difficult to isolate the impact of halving.

- Market Sentiment: Public perception and overall market confidence significantly affect cryptocurrency prices. Positive sentiment surrounding Bitcoin’s future potential can fuel price hikes even without a halving event.

- Regulation: Government regulations and policies towards cryptocurrency can create uncertainty, impacting investor behavior and price movements.

- Institutional Investors: The involvement of major institutions like investment firms can significantly influence demand and price fluctuations.

- Technological Advancements: Developments within the Bitcoin network or the broader blockchain industry can also affect its perceived value.

The Price Impact Timeline

The price increase following a halving isn’t always immediate. In the past, significant price rises have materialized 6 to 12 months after the halving event. This time lag could be due to factors like:

Miner Capitulation: As mining rewards are halved, some miners might shut down operations if profitability falls below a certain threshold. This initial decrease in mining activity can put downward pressure on price.

Market Anticipation: In the lead-up to a halving, investors might buy Bitcoin in anticipation of a future price increase, leading to a gradual price rise before the actual halving.

Technical Analysis of Potential Price Movement

While the impact of halving on price isn’t guaranteed, technical analysis can provide some insights into potential price movements following the event. Here are three common approaches:

Stock-to-Flow Model:

This model, popularized by PlanB, attempts to predict Bitcoin’s price based on its inherent scarcity. It compares the existing stock of Bitcoin (all mined coins) to the flow of newly mined coins (affected by halving). The model suggests a historical correlation between increasing stock-to-flow ratios and rising Bitcoin prices.

By analyzing the projected decrease in new coin flow due to halving, the model can provide a theoretical price target based on historical trends. However, it’s crucial to remember that the model is a simplification and doesn’t account for all market variables.

On-Chain Analysis:

This method analyzes data directly from the Bitcoin blockchain to understand investor behavior and potential price movements. Here are some key metrics to consider:

Exchange Inflows/Outflows: A surge in Bitcoin moving onto exchanges might indicate increased selling pressure, potentially leading to a price dip. Conversely, a rise in outflows suggests investors are moving Bitcoin to cold storage, potentially indicating a buy-and-hold strategy and bullish sentiment.

Active Addresses: The number of unique addresses participating in Bitcoin transactions can reflect overall network activity. An increase in active addresses suggests growing interest and potentially rising prices.

By monitoring these and other on-chain metrics before and after the halving, analysts can gain insights into investor sentiment and potential price movements.

Historical Technical Indicators:

Technical analysts often study historical Bitcoin price charts to identify recurring patterns and predict future trends. Here are a couple of examples:

Relative Strength Index (RSI): This indicator measures price momentum and identifies potential overbought or oversold conditions. Analyzing historical RSI levels around previous halving events can help identify potential price support and resistance zones.

Moving Average Convergence Divergence (MACD): This indicator helps identify trend direction and potential trend reversals. Studying historical MACD patterns post-halving can provide clues about potential price breakouts or continuations of existing trends.

It’s important to remember that technical indicators are not perfect predictors. They should be used in conjunction with other analysis methods to form a more comprehensive picture of potential price movements.

The Impact of the Halving on Bitcoin Miners: Buckle Up!

The Bitcoin halving is like a shot of adrenaline for the Bitcoin ecosystem, but its effects are felt most acutely by the miners who keep the network running. Here’s how the April 2024 halving might impact them:

1. Reduced Profitability:

This is the most immediate and direct consequence. With the block reward cut in half, miners will receive fewer Bitcoins for their efforts. Think of it like their hourly wage getting slashed. The good news? The potential price appreciation of Bitcoin after the halving could offset this decrease, allowing efficient miners to stay profitable.

2. Increased Competition:

The halving might lead to a scramble among miners. With fewer Bitcoins up for grabs, miners might be willing to accept lower profit margins to stay competitive. This could lead to a price war for the most efficient mining hardware and electricity sources. Only the most cost-effective miners are likely to survive this squeeze.

3. Pressure to Adapt:

Miners are a resourceful bunch. The halving might push them to explore new strategies to stay afloat. Here are some possibilities:

- Investing in More Efficient Hardware: Miners might upgrade their equipment to squeeze out every ounce of processing power, allowing them to solve problems faster and potentially earn more Bitcoins despite the reduced reward.

- Joining Mining Pools: Individual miners might band together in “mining pools” to combine their computing power. This allows them to compete more effectively and share the block rewards.

- Shifting Focus to Alternative Cryptocurrencies: Some miners, particularly those with less efficient setups, might decide to shift their focus to mining other cryptocurrencies that offer a more attractive reward structure.

4. Network Security Implications:

The halving could lead to a temporary dip in the hashrate, the total computing power dedicated to securing the Bitcoin network. This is because some less profitable miners might be forced to shut down their operations.

However, the network’s self-regulating mechanisms are likely to kick in, adjusting difficulty to maintain security. This might lead to consolidation within the mining community, with larger mining pools becoming even more dominant.

What Should Investors Expect From the Halving Event?

The upcoming Bitcoin halving in April 2024 has investors around the globe watching with keen interest. While the halving itself doesn’t directly affect existing Bitcoin holders, it has the potential to trigger significant changes within the Bitcoin ecosystem, ultimately impacting investment decisions. Here’s what investors need to consider:

1. Potential Price Volatility:

Historically, Bitcoin prices have experienced significant surges in the months following a halving event. This is due to the core principle of supply and demand. The halving significantly reduces the new supply of Bitcoins entering circulation. In theory, if demand remains constant or even increases, this limited supply could push prices higher. However, it’s important to remember that the cryptocurrency market is notoriously volatile, and past performance is not a guarantee of future results.

2. Long-Term Value Proposition:

The halving reinforces the concept of Bitcoin’s limited supply. With only 21 million Bitcoins ever to be created, the halving events progressively reduce the number of new coins miners can generate. This scarcity could contribute to Bitcoin’s long-term value proposition as a scarce digital asset, potentially attracting more investors and driving prices upwards.

3. A Catalyst for Increased Adoption:

The excitement surrounding the halving event could attract new investors to the Bitcoin market. Increased mainstream media coverage and growing institutional adoption could further fuel investor interest. However, it’s crucial for investors to conduct thorough research and understand the inherent risks associated with cryptocurrency investments before diving in.

4. Not a Guaranteed Moneymaker:

It’s important to manage expectations. The halving doesn’t guarantee a sudden price surge. Several factors beyond supply and demand, such as regulatory changes, technological advancements, and broader economic conditions, can also influence Bitcoin’s price.

5. A Time for Strategic Thinking:

The halving presents an opportunity for investors to reassess their Bitcoin investment strategies. Investors with a long-term perspective might view the halving as a potential buying opportunity due to Bitcoin’s limited supply and potential for future appreciation.

However, those with shorter time horizons or a lower risk tolerance might prefer to wait for the market to stabilize after the halving event.

Final Words

Big shakeup for Bitcoin in April! The halving cuts new bitcoins in half. Will this make the price skyrocket like last time? By learning how it works, we can be ready for this exciting moment in Bitcoin’s story!